Your Software industry financial ratios images are available. Software industry financial ratios are a topic that is being searched for and liked by netizens today. You can Find and Download the Software industry financial ratios files here. Find and Download all free photos.

If you’re searching for software industry financial ratios images information linked to the software industry financial ratios interest, you have come to the ideal blog. Our site frequently gives you hints for seeking the highest quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

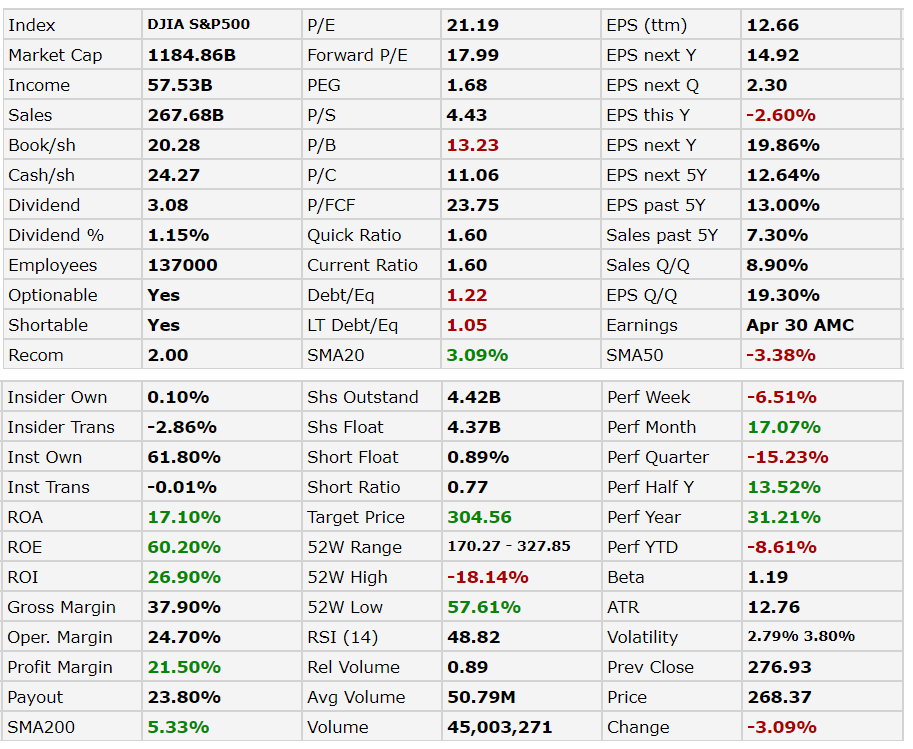

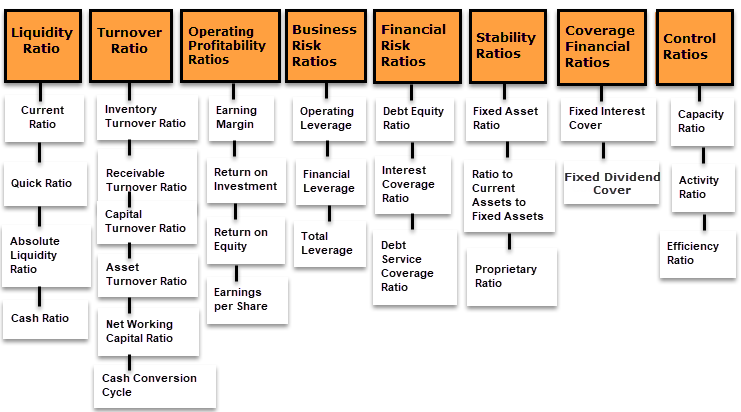

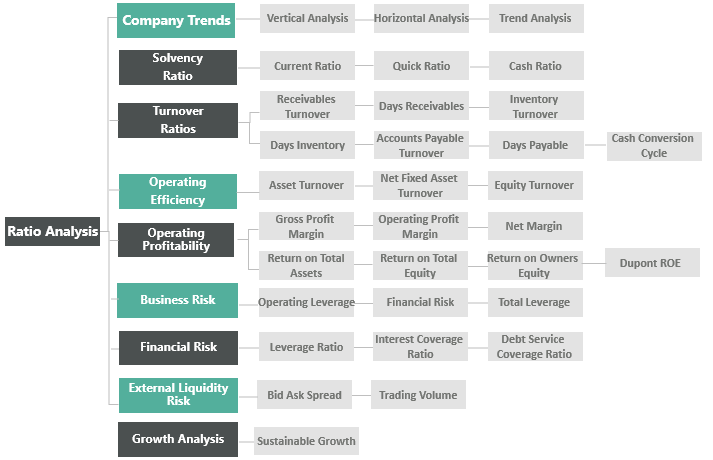

Software Industry Financial Ratios. Ad See the Financial Report Tools your competitors are already using - Start Now. Enhance Your ERP Data w Our Line of Automated Reporting Tools. The software industry has evolved into a number of different business models each with their own set of performance metrics. 220 rows Leverage financial ratios These financial ratios indicate the.

Financial Ratios Used In Performance Evaluation Download Table From researchgate.net

Financial Ratios Used In Performance Evaluation Download Table From researchgate.net

Features of Industry Financial Ratios. Sector and industry weightings are calculated using market capitalization which is converted to USD. Enhance Your ERP Data w Our Line of Automated Reporting Tools. Oracle and Microsoft with current ratios of 3 and 25 are the leading software companies among major players worldwide in terms of ability to pay short-term financial obligations as of 2020. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Asset turnover days 869.

HBS Online offers a unique and highly engaging way to learn vital business concepts.

Ad A better way to do financial consolidation. 22 rows Solvency Ratios. Date Current Assets Current Liabilities Current Ratio. Compare recent years as well as prior year by company revenue. RD spend as a percent of revenue held relatively flat year over year 192 in 2Q16 vs. The software industry has evolved into a number of different business models each with their own set of performance metrics.

Source: towardsdatascience.com

Source: towardsdatascience.com

Data in this page is the median value and its updated daily. Reduce Your Financial Closing Time by up to 80 with LucaNet Financial Software. RD spend as a percent of revenue held relatively flat year over year 192 in 2Q16 vs. Ability to download historical figures back to 2007. 22 rows Solvency Ratios.

Source: articles.bplans.com

Source: articles.bplans.com

The Debt-to-Equity Ratio DE is a financial ratio showing the amount of Stockholders Equity and Debt used to finance a companys Assets. 22 rows Solvency Ratios. Ad Develop financial skills to unlock critical insights into performance. Enhance Your ERP Data w Our Line of Automated Reporting Tools. Ad A better way to do financial consolidation.

Source: investopedia.com

Source: investopedia.com

In 2Q16 public SaaS companies invested a median 383 of total revenue on sales marketing almostdoubletheir on-premise counterparts. 22 rows Activity Ratios. GetApp has the Tools you need to stay ahead of the competition. To search for an industry analysis or a company financial statement analysis within an SIC Code click within the Code column until your industrycompany is displayed or directly input the four digit SIC code for your industrycompanyCompanies displayed under any give SIC Code. In the technology industry it is important to have a high current ratio since the business normally needs to fund all of its operations from current assets such as the cash received from investors.

Source: pinterest.com

Source: pinterest.com

To search for an industry analysis or a company financial statement analysis within an SIC Code click within the Code column until your industrycompany is displayed or directly input the four digit SIC code for your industrycompanyCompanies displayed under any give SIC Code. Compare recent years as well as prior year by company revenue. Enhance Your ERP Data w Our Line of Automated Reporting Tools. Included within Key Statistic chapter of every US NAICS report. Ad Find the Best Financial Software That Will Help You Do What You Do Better.

Source: investopedia.com

Source: investopedia.com

Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. To gauge solvency in the face of Debt a business uses Debt and Equity in a suitable proportion. 22 rows Solvency Ratios. Insightsoftware provides the Solution. The interest expense of a business increases with a rise in the Debt of the company for financing.

Source: cz.pinterest.com

Source: cz.pinterest.com

Interest coverage ratio -249-097-058-116-159-364. Get a Free Demo Now. 22 rows Solvency Ratios. Interest coverage ratio -249-097-058-116-159-364. Ad See the Financial Report Tools your competitors are already using - Start Now.

Source: efinancialmodels.com

Source: efinancialmodels.com

Ad Looking for a Financial Reporting Software. Enhance Your ERP Data w Our Line of Automated Reporting Tools. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Ability to download historical figures back to 2007. Ad Corporate Performance Management software for Finance.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Ad Looking for a Financial Reporting Software. Compare recent years as well as prior year by company revenue. 220 rows Leverage financial ratios These financial ratios indicate the. Computer Programs And Systems Current Ratio Historical Data.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Ad Looking for a Financial Reporting Software. To gauge solvency in the face of Debt a business uses Debt and Equity in a suitable proportion. To search for an industry analysis or a company financial statement analysis within an SIC Code click within the Code column until your industrycompany is displayed or directly input the four digit SIC code for your industrycompanyCompanies displayed under any give SIC Code. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Get a Free Demo Now.

Source: slideteam.net

Source: slideteam.net

To gauge solvency in the face of Debt a business uses Debt and Equity in a suitable proportion. The interest expense of a business increases with a rise in the Debt of the company for financing. On the trailing twelve months basis Current Liabilities decreased faster than Software Programming Industrys Cash cash equivalent this led to improvement in Software Programming Industrys Quick Ratio to 167 in the 4 Q 2021 Quick Ratio remained below Software Programming. Oracle and Microsoft with current ratios of 3 and 25 are the leading software companies among major players worldwide in terms of ability to pay short-term financial obligations as of 2020. Features of Industry Financial Ratios.

Source: workful.com

Source: workful.com

Traditional Software versus SaaS Different Metrics. Enhance Your ERP Data w Our Line of Automated Reporting Tools. Ad Find the Best Financial Software That Will Help You Do What You Do Better. Improve efficiency and reduce manual effort to achieve huge time savings. Automate Annual Reports Management Reports.

Source: tradingsim.com

Source: tradingsim.com

Automate Annual Reports Management Reports. Traditional Software versus SaaS Different Metrics. Ad See the Financial Report Tools your competitors are already using - Start Now. However this represents a modest decline from the 406 SM spend in 2Q15. Ad Corporate Performance Management software for Finance.

Source: researchgate.net

Source: researchgate.net

Saves time reduces risk. Ad Corporate Performance Management software for Finance. Saves time reduces risk. Reduce Your Financial Closing Time by up to 80 with LucaNet Financial Software. Ability to download historical figures back to 2007.

Source: pinterest.com

Source: pinterest.com

Computer Programs And Systems Current Ratio Historical Data. HBS Online offers a unique and highly engaging way to learn vital business concepts. 22 rows Solvency Ratios. Insightsoftware provides the Solution. Ad Corporate Performance Management software for Finance.

Source: aaii.com

Source: aaii.com

Ad Corporate Performance Management software for Finance. Ad A better way to do financial consolidation. Software Programming Industry Financial Strength Information. Saves time reduces risk. Ad See the Financial Report Tools your competitors are already using - Start Now.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Ad A better way to do financial consolidation. Traditional software companies typically focus their business modeling on financial metrics such as recognized revenues operating expenses and profits. Get a Free Demo Now. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Features of Industry Financial Ratios.

Source: tradingsim.com

Source: tradingsim.com

To gauge solvency in the face of Debt a business uses Debt and Equity in a suitable proportion. Features the most widely used financial ratios including liquidity coverage leverage and operating ratios. Get a Free Demo Now. Ad See the Financial Report Tools your competitors are already using - Start Now. To gauge solvency in the face of Debt a business uses Debt and Equity in a suitable proportion.

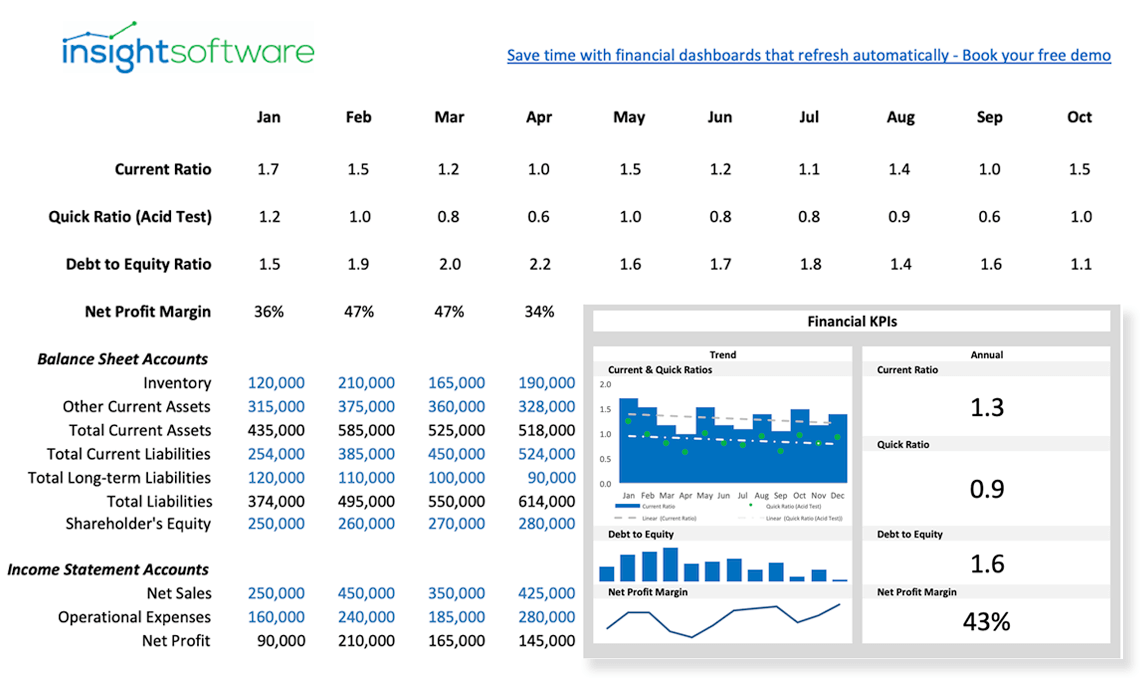

Source: insightsoftware.com

Source: insightsoftware.com

Computer Programs And Systems Current Ratio Historical Data. Get a Free Demo Now. Ad Find the Best Financial Software That Will Help You Do What You Do Better. Ad See the Financial Report Tools your competitors are already using - Start Now. Data in this page is the median value and its updated daily.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title software industry financial ratios by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.