Your Software development costs capitalize images are ready in this website. Software development costs capitalize are a topic that is being searched for and liked by netizens now. You can Find and Download the Software development costs capitalize files here. Get all royalty-free photos and vectors.

If you’re searching for software development costs capitalize pictures information connected with to the software development costs capitalize keyword, you have pay a visit to the right blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

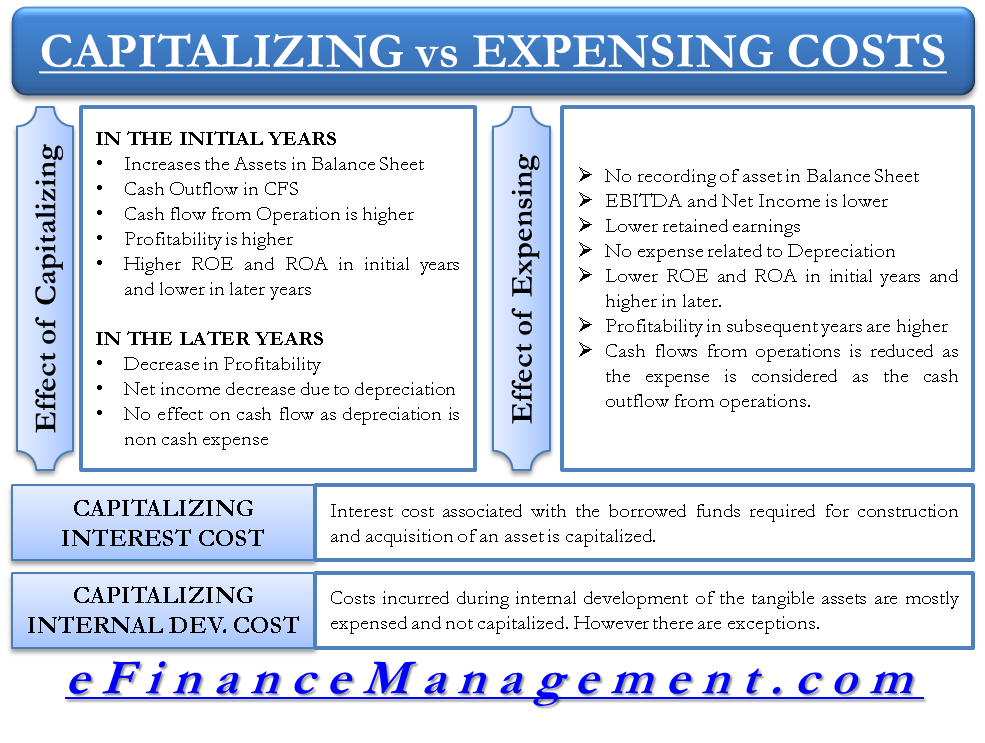

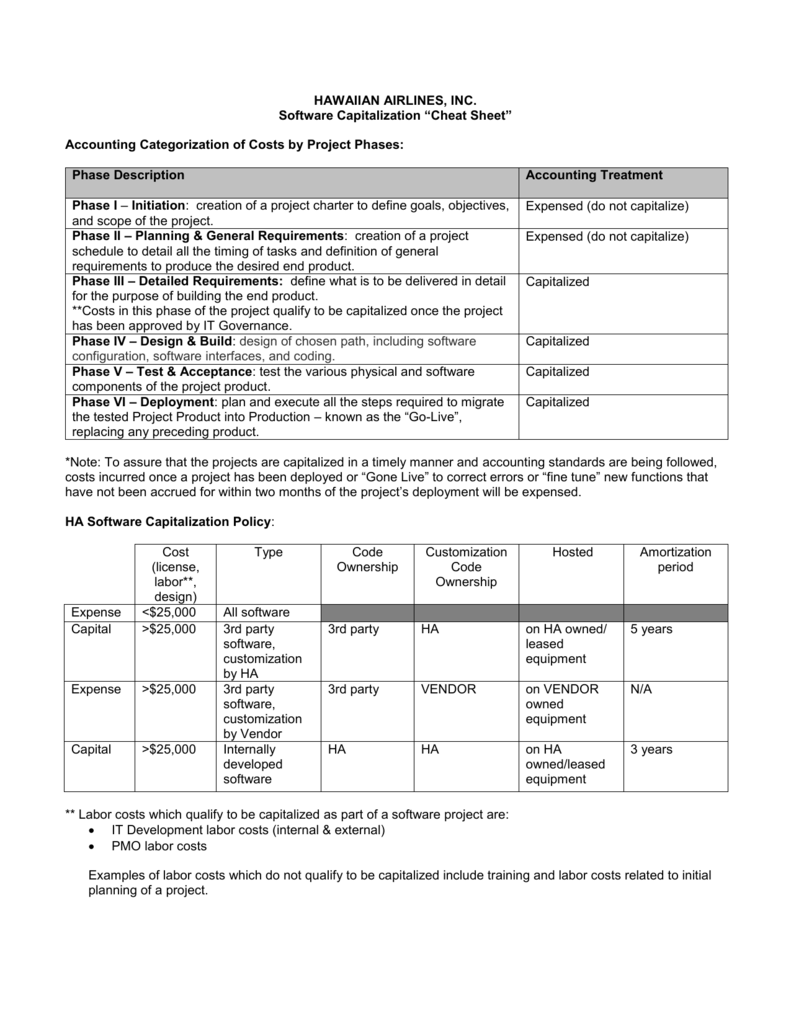

Software Development Costs Capitalize. Capitalization of Software Development Costs for SaaS Companies and Others that Develop Software. Payments to outside contractors and consultants. Payroll and related costs for employees who devote time to and are directly associated with the project. Benefits of capitalizing software.

Primer On Operating Cash Flow Years Ago One Of My Earliest Memories By Ramin Zacharia Medium From medium.com

Primer On Operating Cash Flow Years Ago One Of My Earliest Memories By Ramin Zacharia Medium From medium.com

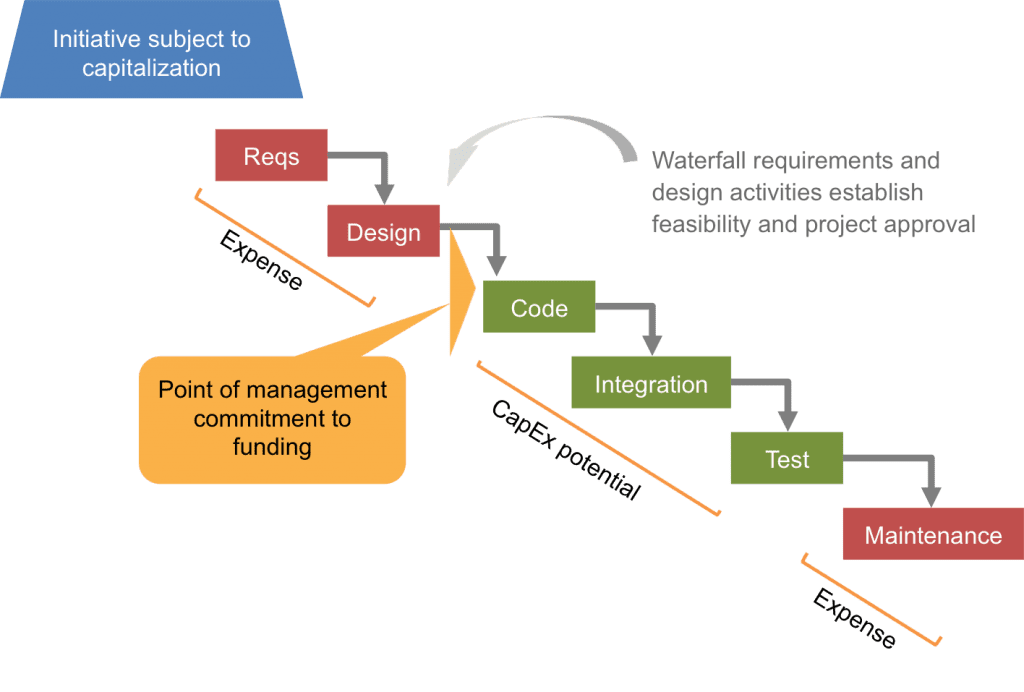

The cost of an internally generated intangible asset includes the. Software costs that qualify for capitalization. On initial recognition an intangible asset should be measured at cost if it is probable that future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably. Software has considerable costs attached which depending on their nature are capitalised as an asset or expensed. For example an agile or iterative software development approach may not have the distinct project stages contemplated in ASC 350-40In that case the reporting entity should. Any costs related to data conversion user training administration and overhead should be charged to expense as incurred.

When the software development process does not follow the same order as outlined above reporting entities should apply the guidance in ASC 350-40 based on the nature of the costs incurred.

Software costs that qualify for capitalization. When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized. When the software development process does not follow the same order as outlined above reporting entities should apply the guidance in ASC 350-40 based on the nature of the costs incurred. For software that the organization aims to sell or market most if not all of the development cost is expensed as incurred. Capitalization of Software Development Costs for SaaS Companies and Others that Develop Software. For example an agile or iterative software development approach may not have the distinct project stages contemplated in ASC 350-40In that case the reporting entity should.

Source: medium.com

Source: medium.com

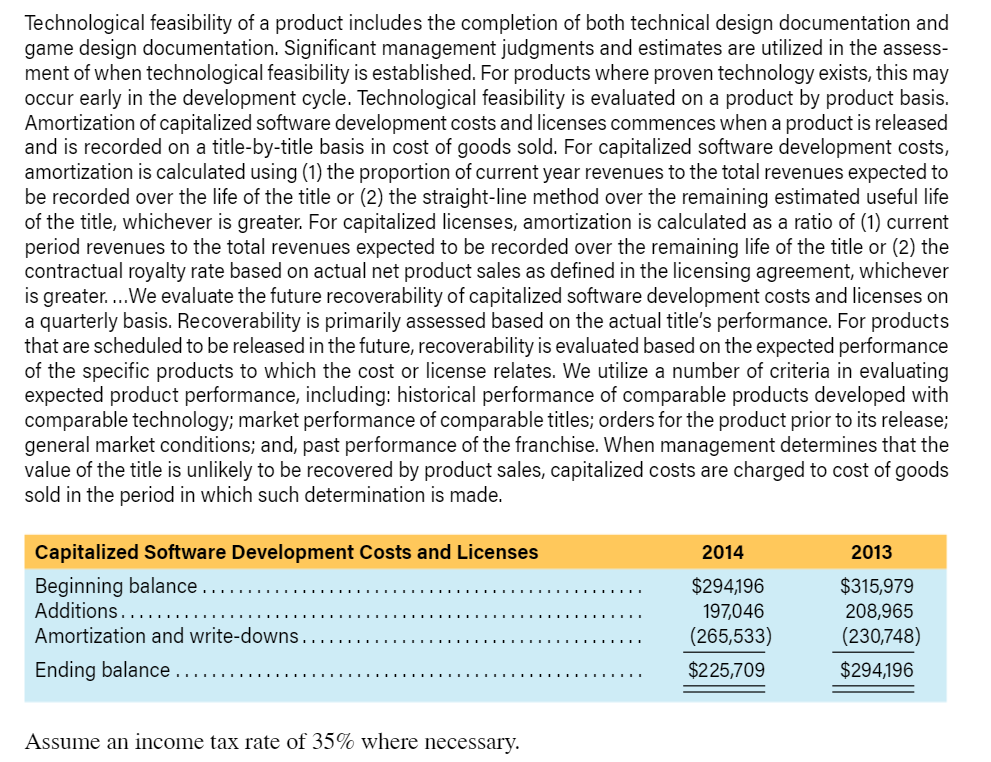

Any software development costs that are incurred prior to the point where the project has demonstrated technological feasibility should be expensed as they are incurred. Allocation to indirect overhead. Software has considerable costs attached which depending on their nature are capitalised as an asset or expensed. We recommend in most cases that companies expense research and development RD in the current period rather than capitalizing the cost and amortizing over a longer period. When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized.

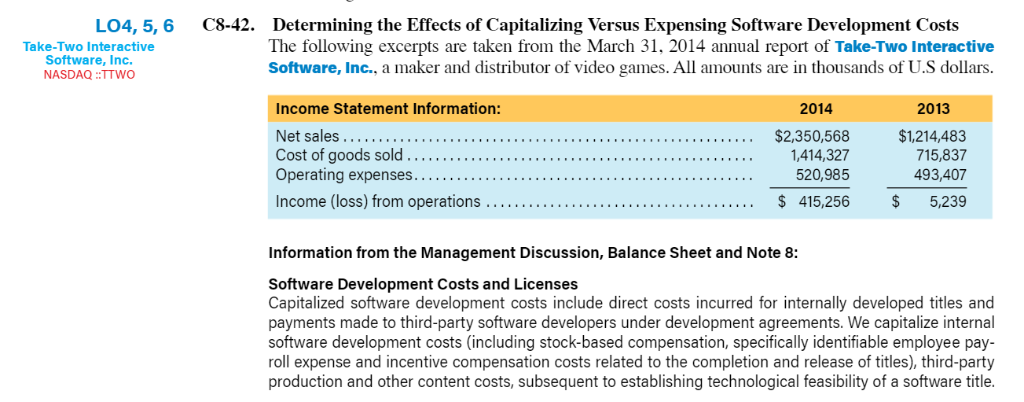

Source: chegg.com

Source: chegg.com

For software that the organization aims to sell or market most if not all of the development cost is expensed as incurred. The cost of an internally generated intangible asset includes the. Any costs related to data conversion user training administration and overhead should be charged to expense as incurred. Interest costs incurred while developing internal-use software. When the software development process does not follow the same order as outlined above reporting entities should apply the guidance in ASC 350-40 based on the nature of the costs incurred.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Allocation to indirect overhead. On initial recognition an intangible asset should be measured at cost if it is probable that future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably. -3 Costs to develop or obtain software that allows for access to or conversion of old data by new systems shall also be capitalized. When qualifying for capitalization software development costs that qualify include. Benefits of capitalizing software.

Source: acq.osd.mil

Source: acq.osd.mil

For software that the organization will deliver as a service on the other hand much of the development cost will likely have to be capitalized. The accounting gets more complicated in practice because only the expenses incurred after the product is deemed technically feasible are capitalized and then just the costs of building enhancements not. For software that the organization aims to sell or market most if not all of the development cost is expensed as incurred. Software has considerable costs attached which depending on their nature are capitalised as an asset or expensed. -4 Training costs are not internal-use software development costs and if incurred during this stage shall be expensed as incurred.

Source: semanticscholar.org

Source: semanticscholar.org

Cost of internally generated intangible assets. It is important these costs are correctly accounted for to provide users of financial statements with accurate information on an entitys software assets and the costs of its operations. Capitalization of Software Development Costs for SaaS Companies and Others that Develop Software. The cost of an internally generated intangible asset includes the. This is the coding stage and also includes any testing before the software goes live.

Source: semanticscholar.org

Source: semanticscholar.org

Payroll and related costs for employees who devote time to and are directly associated with the project. Payroll and related costs for employees who devote time to and are directly associated with the project. So during the product development phase the salary expenses of the developers were not expensed but rather they were capitalized and put on the balance sheet. We recommend in most cases that companies expense research and development RD in the current period rather than capitalizing the cost and amortizing over a longer period. The cost of an internally generated intangible asset includes the.

Source: strmalmblog.wordpress.com

Source: strmalmblog.wordpress.com

Once technological feasibility has been established most but not. So during the product development phase the salary expenses of the developers were not expensed but rather they were capitalized and put on the balance sheet. -3 Costs to develop or obtain software that allows for access to or conversion of old data by new systems shall also be capitalized. Periodically we get asked by our clients about the accounting treatment for the software development costs to develop the services they sell and the sites they use for commerce. When the software development process does not follow the same order as outlined above reporting entities should apply the guidance in ASC 350-40 based on the nature of the costs incurred.

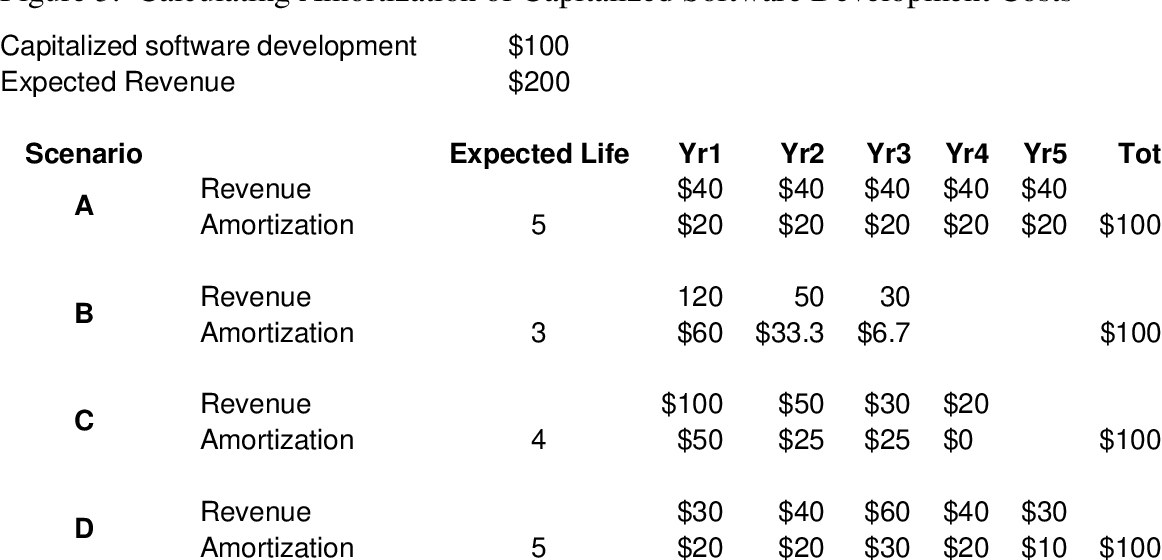

Source: efinancemanagement.com

Source: efinancemanagement.com

Capitalized software is capitalized and then amortized instead of being expensed. It is important these costs are correctly accounted for to provide users of financial statements with accurate information on an entitys software assets and the costs of its operations. Benefits of capitalizing software. Once technological feasibility has been established most but not. Software testing and other direct costs.

Source: tannerco.com

External direct costs of material and services consumed in developing or obtaining internal-use software. When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized. On initial recognition an intangible asset should be measured at cost if it is probable that future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably. Allocation to indirect overhead. ASC 730 Research and Development Applies to costs incurred to internally develop software to be used in research and development.

Source: scaledagileframework.com

Source: scaledagileframework.com

Capitalized software is capitalized and then amortized instead of being expensed. The development expenditure can only be capitalised when. We recommend in most cases that companies expense research and development RD in the current period rather than capitalizing the cost and amortizing over a longer period. The accounting gets more complicated in practice because only the expenses incurred after the product is deemed technically feasible are capitalized and then just the costs of building enhancements not. Capitalize the costs incurred to develop internal-use software which may include coding hardware installation and testing.

Source: dart.deloitte.com

When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized. What software capitalization mean To capitalize is to record the cost of developing a custom software as an expenditure spread over the lifetime of the software instead of being recorded as only a cost in the year that it was created. - there is one or more separate defined projects - expenditure is easily identifiable - the project is commercially viable - the project is technically feasible. When qualifying for capitalization software development costs that qualify include. Benefits of capitalizing software.

Source: scaledagileframework.com

Source: scaledagileframework.com

The accounting gets more complicated in practice because only the expenses incurred after the product is deemed technically feasible are capitalized and then just the costs of building enhancements not. The cost of an internally generated intangible asset includes the. The following development phase costs should be capitalized. What software capitalization mean To capitalize is to record the cost of developing a custom software as an expenditure spread over the lifetime of the software instead of being recorded as only a cost in the year that it was created. Generally Accepted Accounting Principles GAAP currently provide two methods to account for software.

Source: floqast.com

Source: floqast.com

When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized. Payroll and related costs for employees who devote time to and are directly associated with the project. Software costs that qualify for capitalization. Cost of internally generated intangible assets. Interest costs incurred while developing internal-use software.

Source: studylib.net

Source: studylib.net

Capitalized software is capitalized and then amortized instead of being expensed. Any software development costs that are incurred prior to the point where the project has demonstrated technological feasibility should be expensed as they are incurred. Travel for programmers and contractors. When qualifying for capitalization software development costs that qualify include. When developing software for customers companies face the challenging question of which costs should be expensed and which should be capitalized.

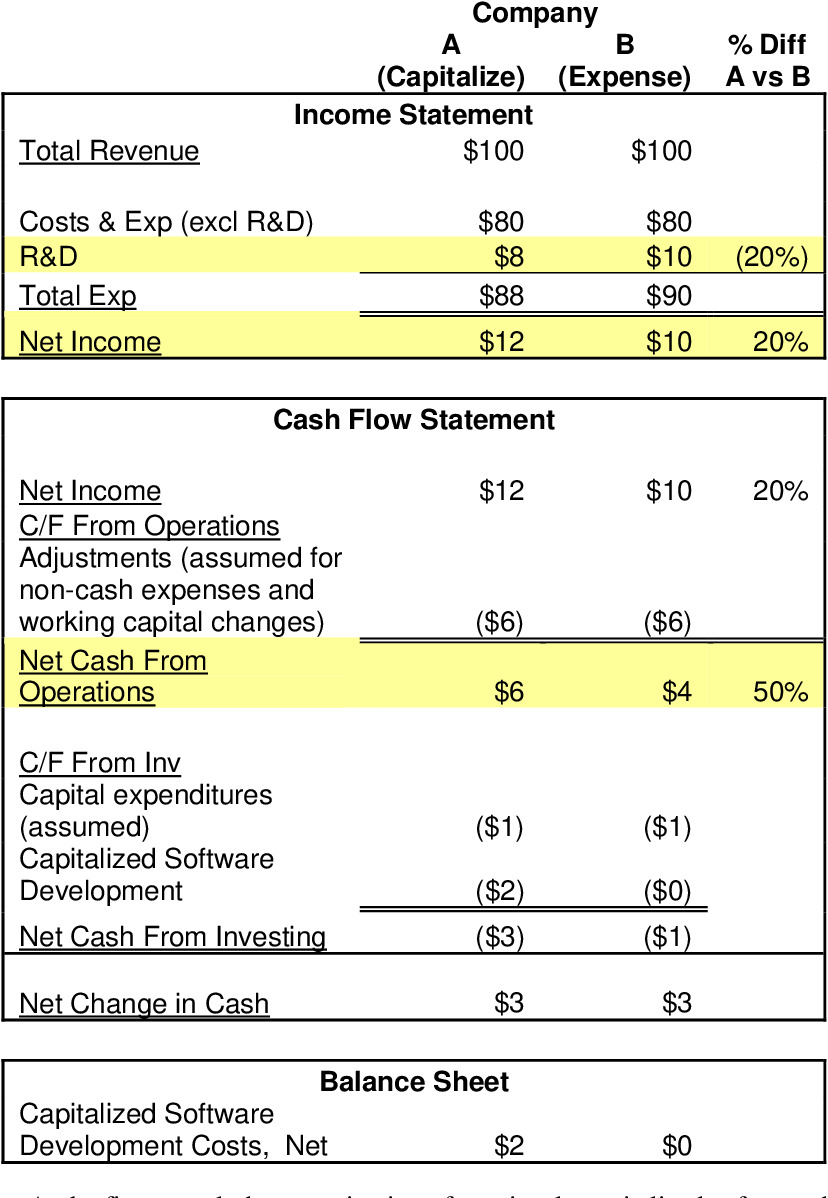

Source: chegg.com

Source: chegg.com

Software costs that qualify for capitalization. For software that the organization will deliver as a service on the other hand much of the development cost will likely have to be capitalized. It is important these costs are correctly accounted for to provide users of financial statements with accurate information on an entitys software assets and the costs of its operations. Periodically we get asked by our clients about the accounting treatment for the software development costs to develop the services they sell and the sites they use for commerce. Capitalize the costs incurred to develop internal-use software which may include coding hardware installation and testing.

Source: wallstreetprep.com

Source: wallstreetprep.com

Interest costs incurred while developing internal-use software. Software has considerable costs attached which depending on their nature are capitalised as an asset or expensed. Allocation to indirect overhead. Once technological feasibility has been established most but not. They cannot capitalise some and not others.

Source: semanticscholar.org

Source: semanticscholar.org

Capitalized software is capitalized and then amortized instead of being expensed. Travel for programmers and contractors. - there is one or more separate defined projects - expenditure is easily identifiable - the project is commercially viable - the project is technically feasible. The accounting gets more complicated in practice because only the expenses incurred after the product is deemed technically feasible are capitalized and then just the costs of building enhancements not. Payroll and related costs for employees who devote time to and are directly associated with the project.

Source: viewpoint.pwc.com

Source: viewpoint.pwc.com

When qualifying for capitalization software development costs that qualify include. So during the product development phase the salary expenses of the developers were not expensed but rather they were capitalized and put on the balance sheet. This is the coding stage and also includes any testing before the software goes live. Applies to software development costs for a software product that will either be sold or embedded in a product that will subsequently be sold leased or otherwise marketed. Payroll and related costs for employees who devote time to and are directly associated with the project.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title software development costs capitalize by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.