Your Software company valuation multiples 2021 images are available. Software company valuation multiples 2021 are a topic that is being searched for and liked by netizens now. You can Find and Download the Software company valuation multiples 2021 files here. Get all royalty-free photos and vectors.

If you’re searching for software company valuation multiples 2021 pictures information linked to the software company valuation multiples 2021 interest, you have pay a visit to the right site. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

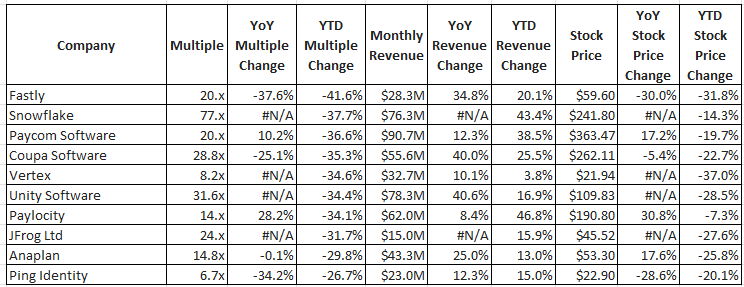

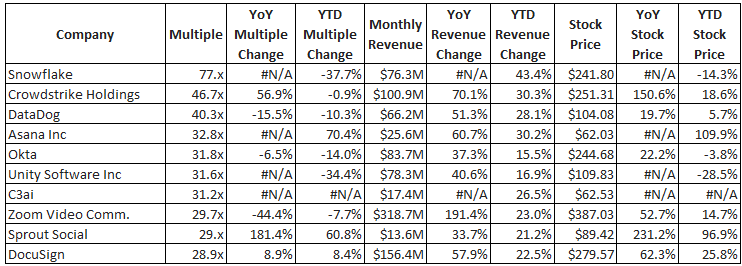

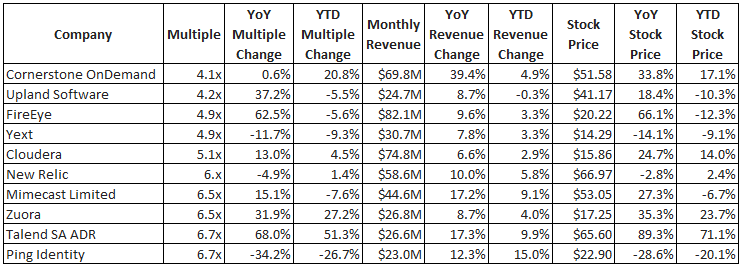

Software Company Valuation Multiples 2021. We found that valuation multiples measured as enterprise value divided by projected revenues for the next 12 months strongly correlate with two factors. EBITDA multiples in 2021 overall are slightly higher For all microcap software companies globally the average EBITDA multiple in 2021 is 191x compared to 187x in 2020. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. GetApp helps more than 18 million businesses find the best software for their needs.

Private Saas Company Valuations Q2 2021 Update Saas Capital From saas-capital.com

Private Saas Company Valuations Q2 2021 Update Saas Capital From saas-capital.com

In a business valuation for software companies the listing price is. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. The median EV Revenue multiple for public B2B SaaS businesses almost doubled in 2020 from 65x Q1 to 122x Q4. Ad See the Business Software your competitors are already using - Start Now. GetApp helps more than 18 million businesses find the best software for their needs. Can be obtained by clicking here.

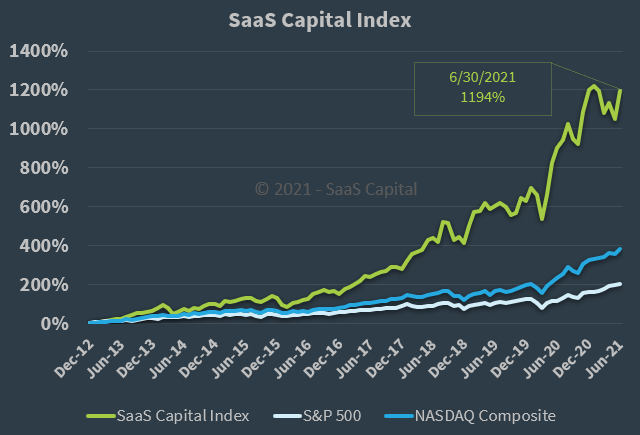

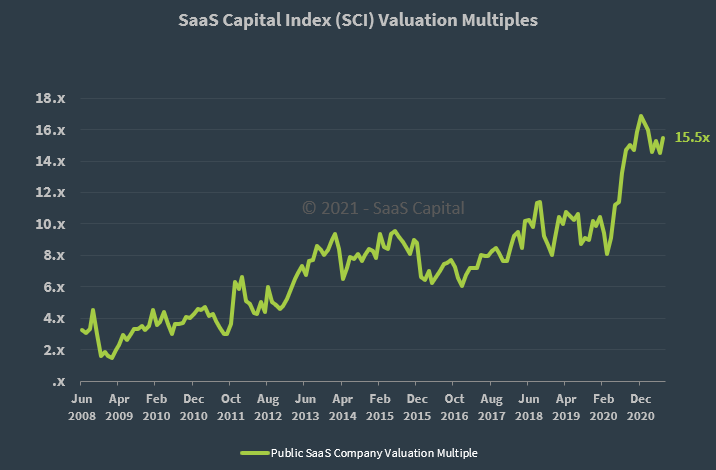

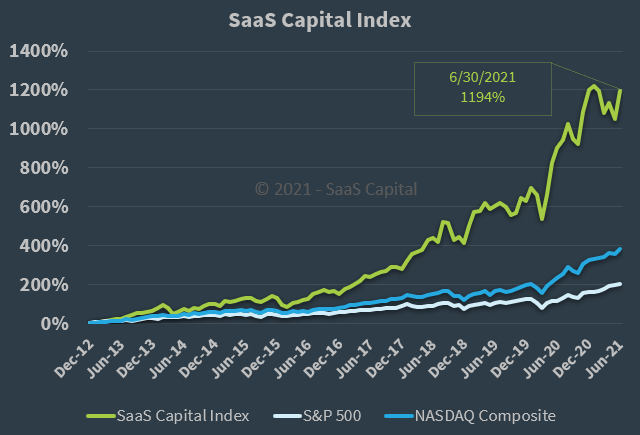

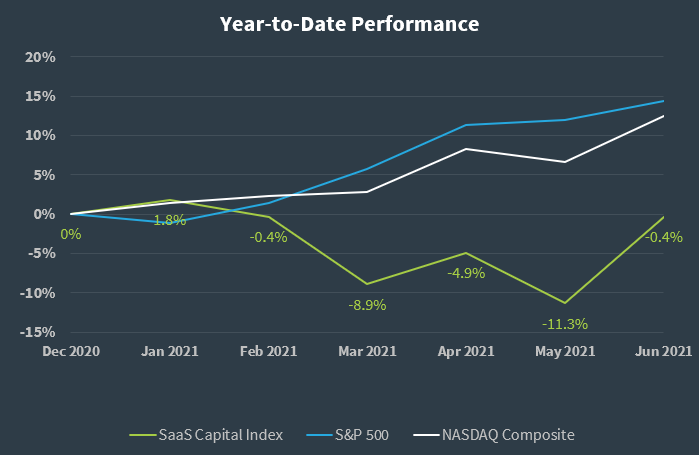

As we can see from the SaaS Capital data revenue multiples of publicly traded SaaS companies went from under 4x in 2008 to over 16x leading into 2021.

Can be obtained by clicking here. Ad See the Business Software your competitors are already using - Start Now. See the value of a company before and after a round of funding. B2B software companies can be valued from anywhere between 3x and 15x their annual revenue – determined by a mixture of parameters who is conducting the valuation and other valuations within the industry at the same time. In a business valuation for software companies the listing price is. Ad See what you can research.

Source: saas-capital.com

Source: saas-capital.com

Can be obtained by clicking here. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4. Our Valuation Multiples by Industry sector reports are based on industry valuation multiples as at. Average net profit for the last year x multiple. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies.

Source: saas-capital.com

Source: saas-capital.com

We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. B2B software companies can be valued from anywhere between 3x and 15x their annual revenue – determined by a mixture of parameters who is conducting the valuation and other valuations within the industry at the same time. See multiples and ratios.

Source: pinterest.com

Source: pinterest.com

PE multiples ranging from 5 to 50 are common in the software industry with growth of company and growth of industry directing the selection of the multiple. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4. See the value of a company before and after a round of funding. B2B SaaS Valuation Multiples. The median EV Revenue multiple for public B2B SaaS businesses almost doubled in 2020 from 65x Q1 to 122x Q4.

Source: microcap.co

Source: microcap.co

We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. We took data from a sample of the last 25 SaaS business acquisitions at FE International ranging from 250000 to 20000000 in value across a variety of niches in both B2B and B2C SaaS. This refers to the Trailing Twelve Months TTM Revenue of the companies in the cohort. Ad See what you can research. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4.

Source: pinterest.com

Source: pinterest.com

Our Valuation Multiples by Industry sector reports are based on industry valuation multiples as at. Ad See the Business Software your competitors are already using - Start Now. Enterprise Value Multiples by Sector US Data Used. On which companies are included in each industry Only positive EBITDA firms. 221 rows The simplicity of this approach leads many practitioners to apply it.

Source: saas-capital.com

Source: saas-capital.com

GetApp helps more than 18 million businesses find the best software for their needs. Taking the average of these yields the companys value under the market approach to be 15699375. Enterprise Value 2019 2020 2021 9 Median Multiples. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. We found a monthly customer churn range of 10 to 110 with an average of 47 annualized 439.

Source: saas-capital.com

Source: saas-capital.com

The median EV Revenue multiple for public B2B SaaS businesses almost doubled in 2020 from 65x Q1 to 122x Q4. See the value of a company before and after a round of funding. In a business valuation for software companies the listing price is. Taking the average of these yields the companys value under the market approach to be 15699375. Average net profit for the last year x multiple.

Source: microcap.co

Source: microcap.co

See multiples and ratios. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. As we can see from the SaaS Capital data revenue multiples of publicly traded SaaS companies went from under 4x in 2008 to over 16x leading into 2021. The first three months of 2021 saw a slight decrease which lowered the median multiple to 102x.

We found a monthly customer churn range of 10 to 110 with an average of 47 annualized 439. GetApp helps more than 18 million businesses find the best software for their needs. As we can see from the SaaS Capital data revenue multiples of publicly traded SaaS companies went from under 4x in 2008 to over 16x leading into 2021. A reasonable valuation is generally around 10 times net income. Valuation Multiples by Industry To download eVals historic Valuation Multiples by Industry reports please click on the relevant download link below.

Source: feinternational.com

Source: feinternational.com

We found that valuation multiples measured as enterprise value divided by projected revenues for the next 12 months strongly correlate with two factors. B2B SaaS Valuation Multiples. GetApp helps more than 18 million businesses find the best software for their needs. Ad See what you can research. GetApp helps more than 18 million businesses find the best software for their needs.

Source: pinterest.com

Source: pinterest.com

CapIQ as of June 30 2019 2020 and 2021 101x 8. We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. GetApp helps more than 18 million businesses find the best software for their needs. To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. B2B SaaS Valuation Multiples.

Source: microcap.co

Source: microcap.co

The median SaaS valuation multiple for public B2B SaaS companies stood at 166x ARR on December 31 2020. The median SaaS valuation multiple for public B2B SaaS companies stood at 166x ARR on December 31 2020. GetApp helps more than 18 million businesses find the best software for their needs. Ad See the Business Software your competitors are already using - Start Now. A positive growth outlook and a US headquarters.

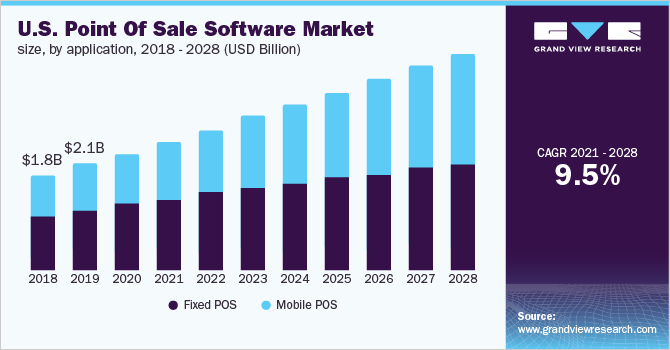

Source: grandviewresearch.com

Source: grandviewresearch.com

2019 - 2021 The median multiple in 2021 for communication was the highest across all sectors EVLTM Revenue by Gross Margin EVLTM Revenue by Company Classification EVLTM Revenue by Revenue Growth EVLTM Revenue by Enterprise Value Sources. A positive growth outlook and a US headquarters. Ad See the Business Software your competitors are already using - Start Now. We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. PE multiples ranging from 5 to 50 are common in the software industry with growth of company and growth of industry directing the selection of the multiple.

Source: saas-capital.com

Source: saas-capital.com

We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. GetApp helps more than 18 million businesses find the best software for their needs. Ad See the Business Software your competitors are already using - Start Now. PE multiples ranging from 5 to 50 are common in the software industry with growth of company and growth of industry directing the selection of the multiple. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4.

Source: saas-capital.com

Source: saas-capital.com

To understand what drives the valuation of software MA transactions we analyzed the valuation of a set of publicly traded software companies. Ad See the Business Software your competitors are already using - Start Now. Enterprise Value Multiples by Sector US Data Used. Exit Investment Tech and Valuation. A positive growth outlook and a US headquarters.

Source: pinterest.com

Source: pinterest.com

See multiples and ratios. In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4. See multiples and ratios. See the value of a company before and after a round of funding. Average net profit for the last year x multiple.

Source: pinterest.com

Source: pinterest.com

We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. Taking the average of these yields the companys value under the market approach to be 15699375. We found a monthly customer churn range of 10 to 110 with an average of 47 annualized 439. Ad See the Business Software your competitors are already using - Start Now. In a business valuation for software companies the listing price is.

Source: pinterest.com

Source: pinterest.com

In our Q3 2020 update we saw that public market valuations for SaaS companies had surged into uncharted territory and the momentum continued into Q4. We begin 2021 with multiples 69 higher than where they stood at the beginning of 2020. A reasonable valuation is generally around 10 times net income. The first three months of 2021 saw a slight decrease which lowered the median multiple to 102x. Enterprise Value 2019 2020 2021 9 Median Multiples.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title software company valuation multiples 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.