Your Drake software roth conversion images are ready in this website. Drake software roth conversion are a topic that is being searched for and liked by netizens today. You can Download the Drake software roth conversion files here. Get all free images.

If you’re looking for drake software roth conversion images information linked to the drake software roth conversion keyword, you have visit the ideal blog. Our website always provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Drake Software Roth Conversion. This calculator is designed to help you determine whether you should consider converting to a Roth IRA. We have proprietary conversion software so we can tell you in a matter of minutes if converting will make sense. I suggest that you delete that 1099-R and re-enter it. No appointment or scheduling necessary.

Roth Distributions And Rollover Youtube From youtube.com

Roth Distributions And Rollover Youtube From youtube.com

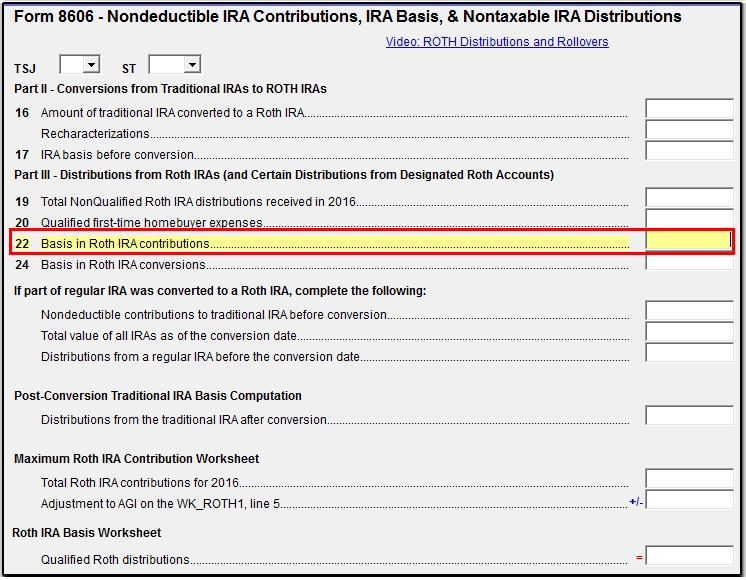

To sign up for a free consultation or to just get more information click here. You must go back and complete the 8606 for 2016. The short answer is yes you can convert a 403 b account to a Roth IRA. Anyone have experience reporting a backdoor Roth contribution in Drake. By Katietsu Tue Feb 27 2018 830 pm. But if you need help just call 828 524-8020.

By Katietsu Tue Feb 27 2018 830 pm.

403 b-to-Roth conversions are allowed. If the amount on line 4 is more than line 3 line 5 will be calculated as zero and the rest of the form will not be completed. The short answer is yes you can convert a 403 b account to a Roth IRA. However one of two conditions has to be met before you can do so. Drake support and the question threads are very helpful. Most conversions can be completed in a few simple steps.

Source: docplayer.net

Source: docplayer.net

However one of two conditions has to be met before you can do so. A Roth IRA based on your estimates on the input page as well as the taxes that would be owed in each case. If you are new to Drake Software you can purchase online here or fill out the New Sale pdf below and fax it to our sales department at 828 369-9928 or. Once processing is complete a notification email will be sent with instructions for retrieving the files. See the field help F1 for more information as to the expected entry for each line on screens 8606 and ROTH.

Source: youtube.com

Source: youtube.com

If you do a Roth IRA conversion youll owe income tax on. Enter most retirement income information such as data related to Roth distributions and rollovers using the 1099 8606 and Roth screens. By Katietsu Tue Feb 27 2018 830 pm. We have proprietary conversion software so we can tell you in a matter of minutes if converting will make sense. I usually google drake software question and the results give the answers I need.

Source: yumpu.com

Source: yumpu.com

If you use Form 1040A and converted from a traditional IRA you report the total amount converted on line 11a and the taxable portion on 11b. However one of two conditions has to be met before you can do so. The short answer is yes you can convert a 403 b account to a Roth IRA. Call if you need more help. Once processing is complete a notification email will be sent with instructions for retrieving the files.

Source: manualzz.com

Source: manualzz.com

Yes beginning in Drake15 a ROTH basis worksheet Wks ROTH_BAS can be produced. But if you need help just call 828 524-8020. This can be filed independently. 403 b-to-Roth conversions are allowed. If you do a Roth IRA conversion youll owe income tax on.

Source: docplayer.net

Source: docplayer.net

Drake support and the question threads are very helpful. If you go with the output of the software your IRA contribution is deductible and your Roth conversion is taxable. In this way if your have no other IRA money a backdoor Roth is equivalent on your tax bill to funding your Roth IRA directly in the first place. In order to track basis the current basis must be entered on the ROTH screen. The results below and on the following page show the projected value of a traditional IRA vs.

Source: studylib.net

Source: studylib.net

The short answer is yes you can convert a 403 b account to a Roth IRA. After misunderstanding they send a scary CP2000 form called IRS Notice of Proposed Adjustment for Underpayment Overpayment and require the taxpayer to either send justification of their filing or pay significantly more in taxes and interest. To report a backdoor Roth correctly it is important to enter the 1099-R into the system correctly and answer the follow-up questions so that the conversion is reported as it should be on the return. The 1001 basis must then be carryforwarded to the 2017 return form 8606 under basis in traditional IRAs for 2016 and earlier. Drake support and the question threads are very helpful.

Source: youtube.com

Source: youtube.com

Most conversions can be completed in a few simple steps. No appointment or scheduling necessary. Drake support and the question threads are very helpful. This calculator is designed to help you determine whether you should consider converting to a Roth IRA. Having difficulty with the 1099-r - once I plug in info from here software is counting this as income and significant reduces return.

Enter most retirement income information such as data related to Roth distributions and rollovers using the 1099 8606 and Roth screens. First complete Form 8606 to determine the taxable portion of your conversion. Welcome to Client Data Conversions. If you do a Roth IRA conversion youll owe income tax on. Yes beginning in Drake15 a ROTH basis worksheet Wks ROTH_BAS can be produced.

Source: reddit.com

Source: reddit.com

Lake Elmo MN 55042. Drake tax software and backdoor roth ira conversion help. You normally have to click within the entry field and then press F1 to get specific advice on the line item. If line 5 on Form 8606 is blank verify the amount entered on line 4 of screen 8606. There doesnt seem to.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

A Roth IRA based on your estimates on the input page as well as the taxes that would be owed in each case. To report a backdoor Roth correctly it is important to enter the 1099-R into the system correctly and answer the follow-up questions so that the conversion is reported as it should be on the return. If you use Form 1040A and converted from a traditional IRA you report the total amount converted on line 11a and the taxable portion on 11b. You normally have to click within the entry field and then press F1 to get specific advice on the line item. After misunderstanding they send a scary CP2000 form called IRS Notice of Proposed Adjustment for Underpayment Overpayment and require the taxpayer to either send justification of their filing or pay significantly more in taxes and interest.

You normally have to click within the entry field and then press F1 to get specific advice on the line item. See the field help F1 for more information as to the expected entry for each line on screens 8606 and ROTH. If the amount on line 4 is more than line 3 line 5 will be calculated as zero and the rest of the form will not be completed. Enter most retirement income information such as data related to Roth distributions and rollovers using the 1099 8606 and Roth screens. First complete Form 8606 to determine the taxable portion of your conversion.

There doesnt seem to. I usually google drake software question and the results give the answers I need. In order to track basis the current basis must be entered on the ROTH screen. If you are a current Drake Software customer contact our accounting department at 828 349-5900 for help filling out the renewal form below. Drake support and the question threads are very helpful.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

The results below and on the following page show the projected value of a traditional IRA vs. To sign up for a free consultation or to just get more information click here. 8530 Eagle Point Blvd Suite 125. First complete Form 8606 to determine the taxable portion of your conversion. But if you need help just call 828 524-8020.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

If you convert money to a Roth IRA you must file your taxes with either Form 1040 or form 1040a. To sign up for a free consultation or to just get more information click here. The results below and on the following page show the projected value of a traditional IRA vs. If line 5 on Form 8606 is blank verify the amount entered on line 4 of screen 8606. A Roth IRA based on your estimates on the input page as well as the taxes that would be owed in each case.

Source: youtube.com

Source: youtube.com

If you have no IRA balance you can make a nondeductible contribution and then convert that contribution to Roth IRA and 100 of your Roth conversion will be after-tax and thus not taxable. By Katietsu Tue Feb 27 2018 830 pm. Call if you need more help. If the amount on line 4 is more than line 3 line 5 will be calculated as zero and the rest of the form will not be completed. We have proprietary conversion software so we can tell you in a matter of minutes if converting will make sense.

Source: yumpu.com

Source: yumpu.com

The short answer is yes you can convert a 403 b account to a Roth IRA. Yes beginning in Drake15 a ROTH basis worksheet Wks ROTH_BAS can be produced. To report a backdoor Roth correctly it is important to enter the 1099-R into the system correctly and answer the follow-up questions so that the conversion is reported as it should be on the return. The deduction offsets the taxable conversion. You end up in the same bottom line as making the contribution non-deductible and not pay tax on that part of the conversion.

Source: reddit.com

Source: reddit.com

Files can be submitted at any time and once successfully received a confirmation email with an identifying submission number will be sent by our system. But if you need help just call 828 524-8020. You must go back and complete the 8606 for 2016. Call if you need more help. Welcome to Client Data Conversions.

Source: yumpu.com

Source: yumpu.com

Also within the software you can press F1 to get some help. To sign up for a free consultation or to just get more information click here. The deduction offsets the taxable conversion. We have proprietary conversion software so we can tell you in a matter of minutes if converting will make sense. You end up in the same bottom line as making the contribution non-deductible and not pay tax on that part of the conversion.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title drake software roth conversion by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.