Your Can i file just state taxes with hr block images are ready. Can i file just state taxes with hr block are a topic that is being searched for and liked by netizens now. You can Find and Download the Can i file just state taxes with hr block files here. Download all free photos and vectors.

If you’re searching for can i file just state taxes with hr block pictures information related to the can i file just state taxes with hr block keyword, you have visit the ideal blog. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

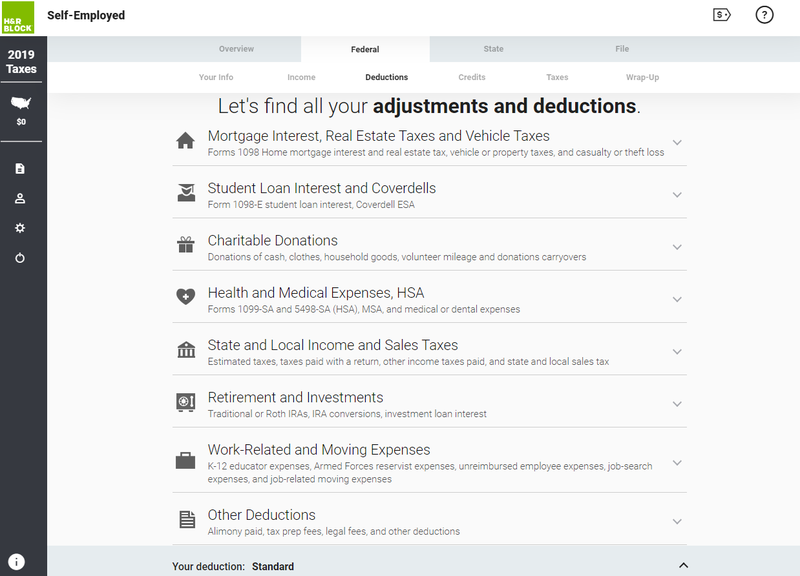

Can I File Just State Taxes With Hr Block. HR Blocks Premium pricing tier is one of its most competitively priced tiers. You are correct - that the form 1040X should be used. HR Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an. For the 2020 version Im not sure if previous answers from tax year 2019 still apply.

If you did not file a federal return with TurboTax you are not able to e-file just the state in TurboTax since it pulls information from the federal return. Were sorry you cant e-file your New York return. So if you have both that would be 10498 plus possible sales tax. About The Tax Institute at HR Block. - Refund Reveal tells you in real-time when and. NY - This return contains NY household income not equal to FD Household income.

Do-it-yourself online packages the option to add Online Assist ie.

If you have already filed a federal return elsewhere it is recommended that you file your state returns with that provider as well. The New York Status update is ready. By the way tax software doesnt suck unless you are a tax pro who is trying to convince you that you cant file by yourself instead of engaging the services of a probably overpriced tax pro. - Refund Reveal tells you in real-time when and. HR Block and the New York tax office are working hard to get state e-filing ready for you. You may also go to the state website for assistance.

Source: pinterest.com

Source: pinterest.com

Were sorry you cant e-file your New York return. Like HR Block TurboTax has a free filing option that allows you to file your federal return and one state return at no cost. The estimated update ready time is now set to Feb 15. TurboTax or HR Block will NOT DOWNGRADE 2 you but only pressure you to. Posted on Nov 8 2013.

Source: businessinsider.com

I successfully e-filed my federal taxes using HR Block but when I went to do my state taxes it gave me this message. About The Tax Institute at HR Block. If you did not file a federal return with TurboTax you are not able to e-file just the state in TurboTax since it pulls information from the federal return. The Tax Institute at HR Block is the go-to source for objective insights on federal and state tax laws affecting the individual. 0 Online Federal Tax Filing 0 Per State Filed.

Source: pinterest.com

Source: pinterest.com

We support e-filing part-year andor nonresident returns for. Users can also opt for Worry-Free Audit assistance which costs 1999 and provides support if you are audited. On-Line Taxes This one is pretty simple. It provides nonpartisan information and analysis on the real world implications of tax policies and proposals to policymakers journalists experts and tax preparers. You are correct - that the form 1040X should be used.

Source: fool.com

Source: fool.com

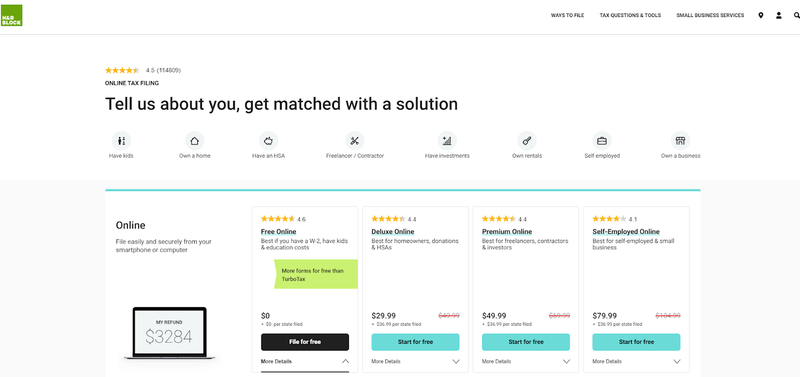

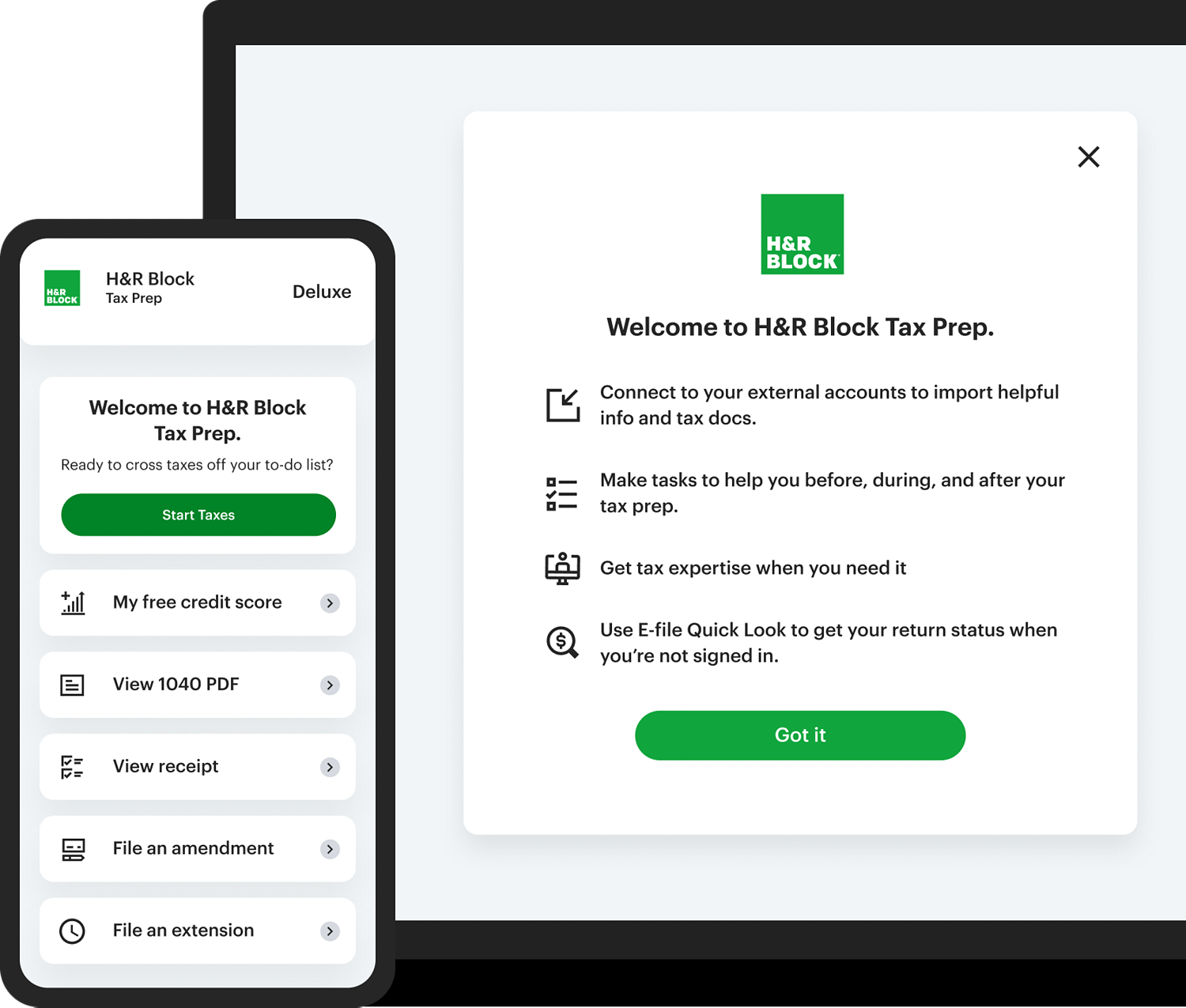

HR Block offers four main ways to prepare and file taxes. In any case as of March 19 2021 theres a nasty bug in the Deluxe eFile State version Windoze where after completing the Federal return the State software download and install proc. HR Block has four major pricing tiers including a completely free State and Federal filing cost 0 option. Were sorry you cant e-file your New York return. You can recreate your federal in TurboTax to generate the state but youd have to print and mail the state return.

Source: businessinsider.com

I successfully e-filed my federal taxes using HR Block but when I went to do my state taxes it gave me this message. So if you have both that would be 10498 plus possible sales tax. Yes to only file a state return you will need to mail your state return. For most states you can file nonresident and part-year resident state returns using HR Blocks State tax software. You could not imagine how fast it is you could spend hours of hours or even days to finish all your tax return with mistakes while HR BLOCK provide.

Source: pinterest.com

Source: pinterest.com

So if you have both that would be 10498 plus possible sales tax. Not only does HR Block Free allow you to file Federal and State free but it also includes more credits and deductions than their competitors. HR Block has four major pricing tiers including a completely free State and Federal filing cost 0 option. The Tax Institute at HR Block is the go-to source for objective insights on federal and state tax laws affecting the individual. You do not need to include a copy of your original tax return because the IRS already has that information.

Source: pinterest.com

Source: pinterest.com

The estimated update ready time is now set to Feb 15. HR Block offers four main ways to prepare and file taxes. If you try to use Free Edition and have to upgrade then Online Deluxe is currently 5999 and a state return is 4499. I successfully e-filed my federal taxes using HR Block but when I went to do my state taxes it gave me this message. You can recreate your federal in TurboTax to generate the state but youd have to print and mail the state return.

Source: pinterest.com

Source: pinterest.com

Im not sure that will work. If they will reimburse you for any late filing and late payment penalties then you should just try to work it out with HR. HR Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an. We support e-filing part-year andor nonresident returns for. Do not send anything unnecessary to avoid confusions.

Source: newsweek.com

Source: newsweek.com

If you did not file a federal return with TurboTax you are not able to e-file just the state in TurboTax since it pulls information from the federal return. You can only e-file a state return on FreeTaxUSA if you also e-file your federal return on FreeTaxUSA. You may also go to the state website for assistance. If you filed your federal return with us. By the way tax software doesnt suck unless you are a tax pro who is trying to convince you that you cant file by yourself instead of engaging the services of a probably overpriced tax pro.

Source: moneyunder30.com

Source: moneyunder30.com

0 Online Federal Tax Filing 0 Per State Filed. So if you have both that would be 10498 plus possible sales tax. If they know they made the error and did not file the. You can file any number of state returns with. In any case as of March 19 2021 theres a nasty bug in the Deluxe eFile State version Windoze where after completing the Federal return the State software download and install proc.

Source: pinterest.com

Source: pinterest.com

HR Blocks Premium pricing tier is one of its most competitively priced tiers. - Refund Reveal tells you in real-time when and. If you filed your federal return with us. You can only e-file a state return on FreeTaxUSA if you also e-file your federal return on FreeTaxUSA. You could not imagine how fast it is you could spend hours of hours or even days to finish all your tax return with mistakes while HR BLOCK provide.

Yes to only file a state return you will need to mail your state return. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. You are correct - that the form 1040X should be used. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. 0 Online Federal Tax Filing 0 Per State Filed.

Source: pinterest.com

Source: pinterest.com

Extra help from an expert full service from a tax preparer and. HR Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an. You can only e-file a state return on FreeTaxUSA if you also e-file your federal return on FreeTaxUSA. Your account will still be charged the federal tax preparation fee if any when filing a State Only return. Extra help from an expert full service from a tax preparer and.

Were sorry you cant e-file your New York return. So if you have both that would be 10498 plus possible sales tax. HR Block and the New York tax office are working hard to get state e-filing ready for you. Youll need a state update to e-file and well post the update as soon as e-file is ready. Like HR Block TurboTax has a free filing option that allows you to file your federal return and one state return at no cost.

Source: pinterest.com

Source: pinterest.com

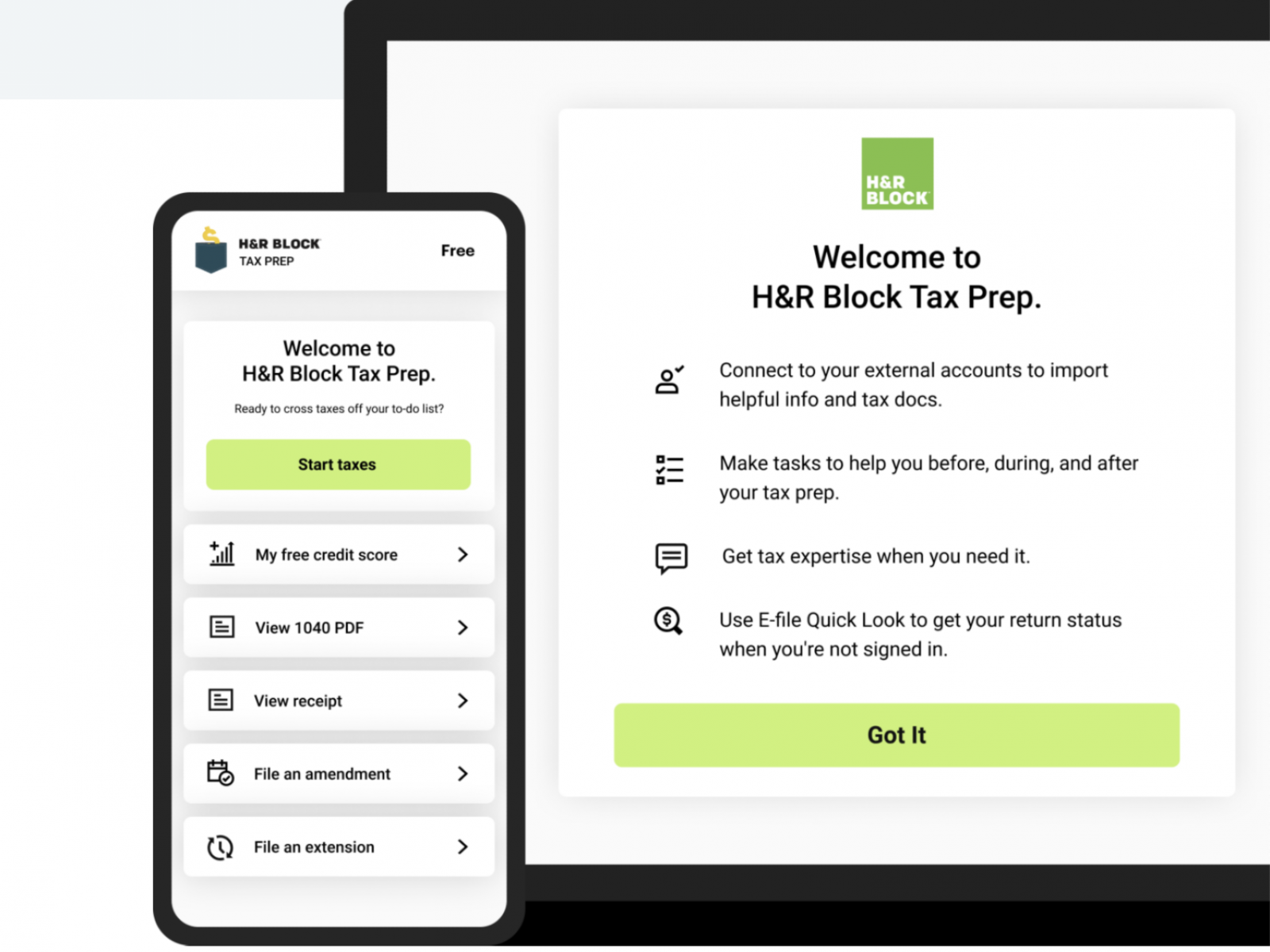

Can I file just a state return. On-Line Taxes This one is pretty simple. Can I file just a state return. - Snap a picture of your W-2 upload it and HR Block automatically fills in your information. Not only does HR Block Free allow you to file Federal and State free but it also includes more credits and deductions than their competitors.

Source: pinterest.com

Source: pinterest.com

If you filed your federal return with us. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. You have to have an. File your 2020 federal return for free with HR Block Free Edition online includes more forms for free than TurboTax. Extra help from an expert full service from a tax preparer and.

Source: businessinsider.com

If you try to use Free Edition and have to upgrade then Online Deluxe is currently 5999 and a state return is 4499. So if you have both that would be 10498 plus possible sales tax. For most states you can file nonresident and part-year resident state returns using HR Blocks State tax software. By the way tax software doesnt suck unless you are a tax pro who is trying to convince you that you cant file by yourself instead of engaging the services of a probably overpriced tax pro. For the 2020 version Im not sure if previous answers from tax year 2019 still apply.

Source: fool.com

Source: fool.com

Desktop Deluxe is 7999 when purchased as a download directly from TurboTax and. - Snap a picture of your W-2 upload it and HR Block automatically fills in your information. You may also go to the state website for assistance. Users can also opt for Worry-Free Audit assistance which costs 1999 and provides support if you are audited. Your account will still be charged the federal tax preparation fee if any when filing a State Only return.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can i file just state taxes with hr block by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.